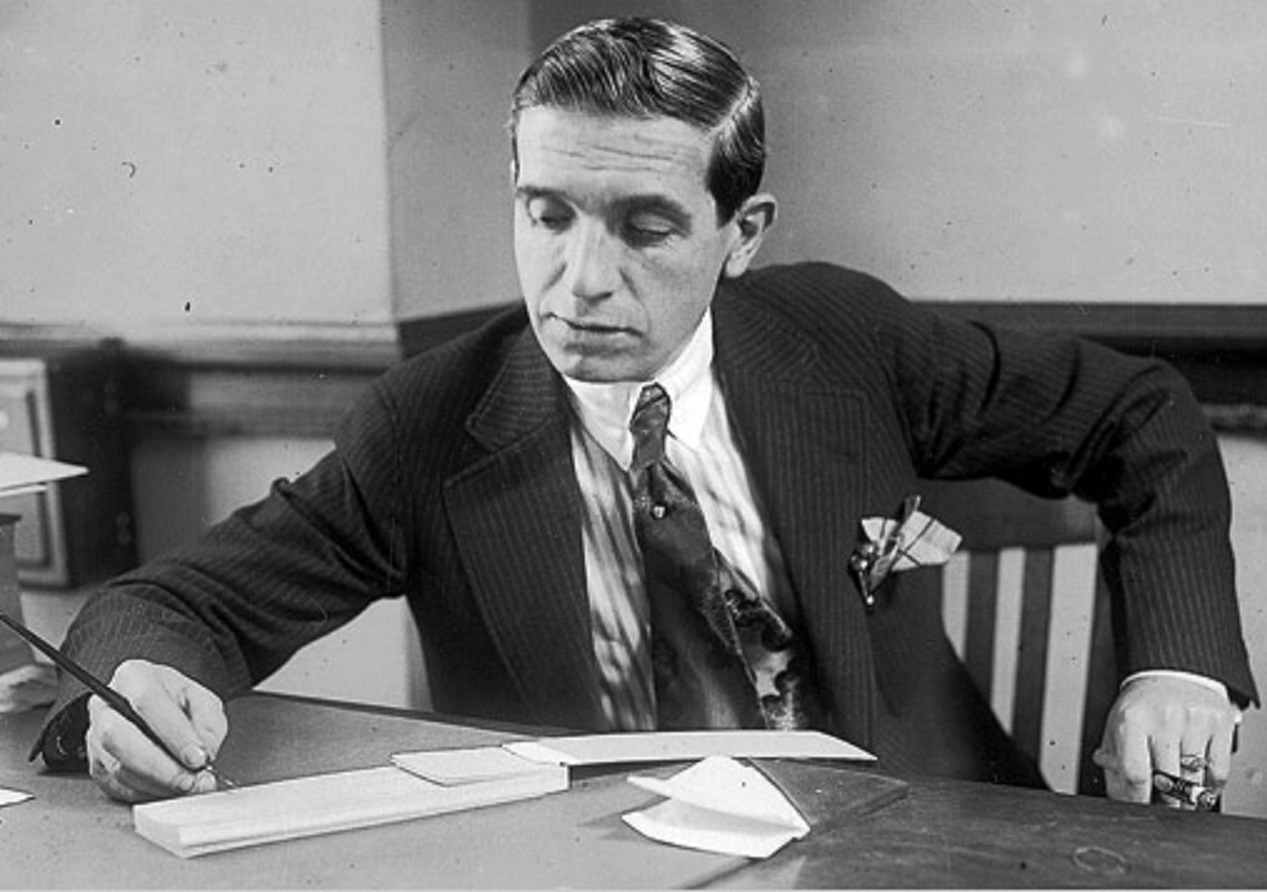

An Italian immigrant who arrived in the United States in 1903 with just $2.50 in his pocket, Charles Ponzi ascended from obscurity to dizzying wealth seemingly overnight. But under the surface of his extraordinary wealth was one of the most infamous frauds in financial history—a scheme so influential that it gave rise to the term “Ponzi scheme.”

A Scheme Is Born

Ponzi’s plan was rooted in international reply coupons (IRCs), a type of voucher used to pre-pay postage on international mail. After noticing a disparity in the value of IRCs between countries due to currency fluctuations following World War I, Ponzi theorized that he could buy IRCs cheaply in Europe and redeem them in the U.S. at a profit. In theory, this arbitrage could yield substantial returns.

A Simple Scheme

However, the logistics of executing such a plan on a large scale were unworkable. Instead of actually buying and selling IRCs, Ponzi began soliciting investments from the public with the promise of 50% returns in 45 days, or 100% in 90 days. To pay off early investors, he simply used the money from newer ones, or "robbed Peter to pay Paul" as he liked to call it. The profits weren’t coming from any real business activity but were funded entirely by a growing pool of deposits.

Public Frenzy And Media Spotlight

Between late 1919 and mid-1920, Ponzi’s scheme exploded. Using his company, the Securities Exchange Company, he promised riches to thousands of investors, many of them immigrants like himself who trusted him because he spoke their language and seemed to understand their struggles. At the height of the frenzy, Ponzi was raking in as much as $250,000 a day (equivalent to over $3 million today).

The Media Hails The Magic Man

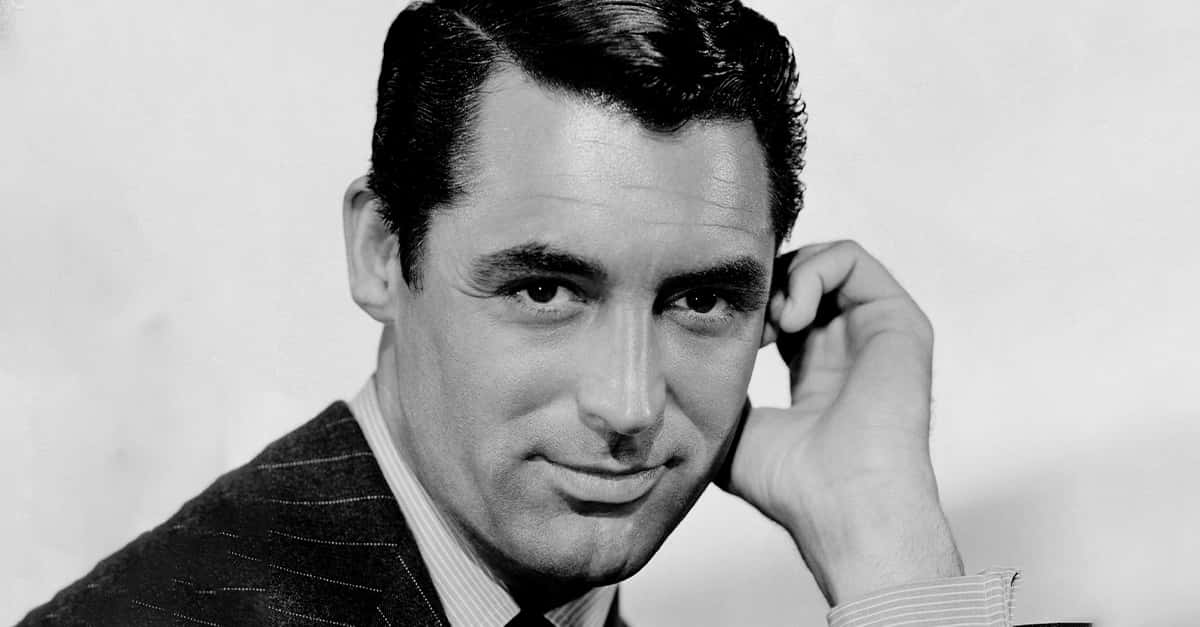

Newspapers covered Ponzi’s success breathlessly. His wealth and generosity made headlines, with reporters detailing his expensive suits, extravagant meals, and acts of charity. Even as skepticism about his business model began to surface, public trust in Ponzi remained high. For a time, he even considered launching his own bank.

Built On A Wobbly Foundation

Despite his efforts to maintain the illusion of legitimacy, scrutiny mounted. Financial journalists and skeptical bankers began asking questions that Ponzi couldn’t answer. The Boston Post played a key role in investigating Ponzi, publishing a series of articles that questioned his business model and financial solvency. A damning report from Clarence Barron, the publisher of the Wall Street Journal, noted that Ponzi hadn’t invested in enough IRCs to justify his returns.

Almanac: Charles Ponzi and his Ponzi Scheme,(CBS Sunday Morning ), CBS News Productions

Almanac: Charles Ponzi and his Ponzi Scheme,(CBS Sunday Morning ), CBS News Productions

The Hammer Falls

The investigation culminated in a raid on Ponzi’s offices in July 1920, and by mid-August, the entire scheme collapsed. The truth emerged: Ponzi had only purchased about $30 worth of IRCs, and of the millions he had collected from investors, most had been used to pay off earlier investors or finance his extravagant lifestyle.

Final Verdict

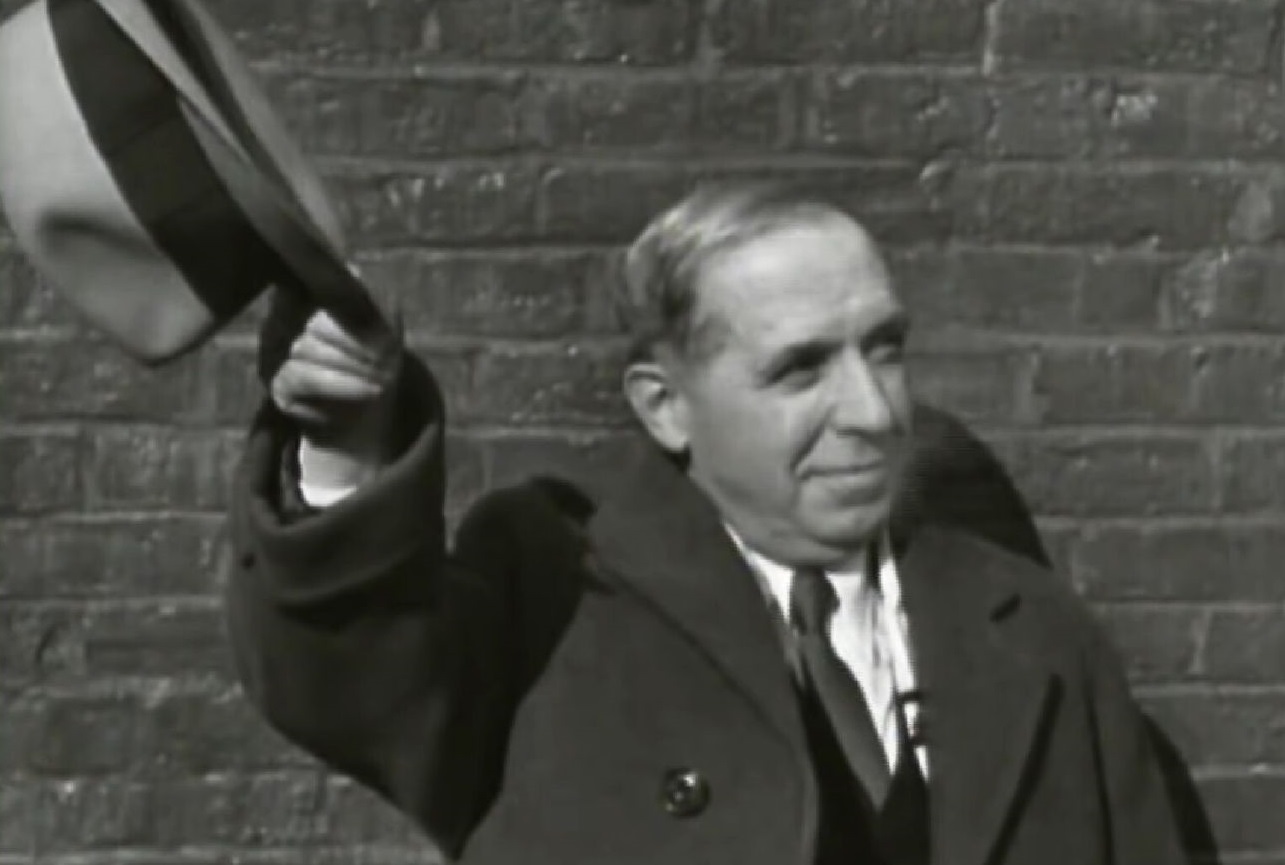

Charles Ponzi was charged with multiple counts of mail fraud. He was convicted and sentenced to five years in federal prison. After serving his time, he was tried again by the state of Massachusetts, sentenced to additional prison time, and ultimately shipped to Italy in 1934. He passed away in poverty and obscurity in Brazil in 1949.

Almanac: Charles Ponzi and his Ponzi Scheme,(CBS Sunday Morning ), CBS News Productions

Almanac: Charles Ponzi and his Ponzi Scheme,(CBS Sunday Morning ), CBS News Productions

Victims Of A Swindler

The scandal ruined thousands of investors, many of whom lost their life savings. It also changed how regulators viewed financial fraud, leading to increased scrutiny and regulatory reforms over the years.

Famous For All The Wrong Reasons

Ponzi’s name is now synonymous with financial deception. The term "Ponzi scheme" describes any investment scheme where returns are paid to earlier investors using the capital from newer investors, rather than legitimate profit. Though schemes of this kind have evolved and resurfaced in different forms—most notably in the case of Bernie Madoff—the blueprint remains essentially unchanged.

You May Also Like:

Guilty Facts About James Fisk, The Fraudulent Financier

Bad-Blooded Facts About Elizabeth Holmes, The Mind Behind The Theranos Scandal