“Greed is good,” said Gordon Gekko, the villain of the 1987 movie Wall Street. Unfortunately, some real-life Wall Street traders took Gekko’s advice seriously, and in doing so, ruined countless lives. Here are 24 of the slimiest Wall Street scandals.

1. Bernie Madoff

Bernie Madoff’s name became synonymous with shady dealings after the 2008 recession. For nearly 30 years, Madoff operated a Ponzi scheme, offering stock deals to a select group, explaining his methods “were too complicated for outsiders to understand". But as banks faltered toward the end of 2008, Madoff’s scheme was revealed. Investors lost $50 billion and some clients even took their own lives.

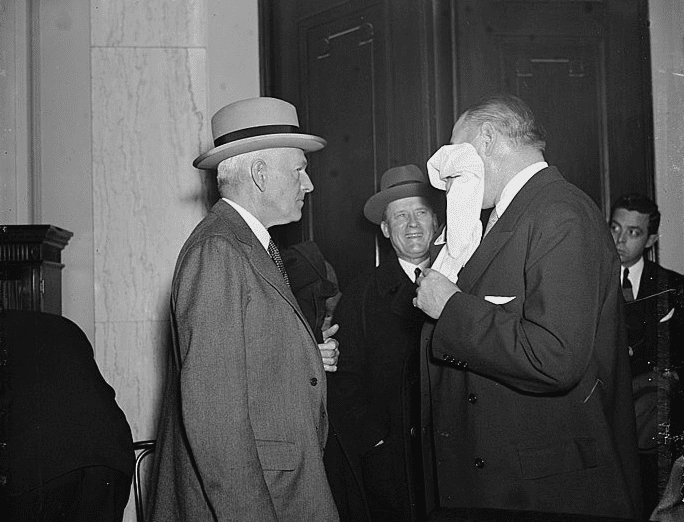

2. The Wiggin Act

Just as Madoff became the face of the 2008 Recession, Albert H. Wiggin, a top banker at Chase National, became the face of the Great Depression. Even as he helped Chase expand in the early 20th century, he was shorting the bank’s stock. When the market crashed in 1929, Wiggin pocketed an immense profit of $4 million—a stark breach of trust so extreme that the US government labeled their law barring insider trading as "the Wiggin Act".

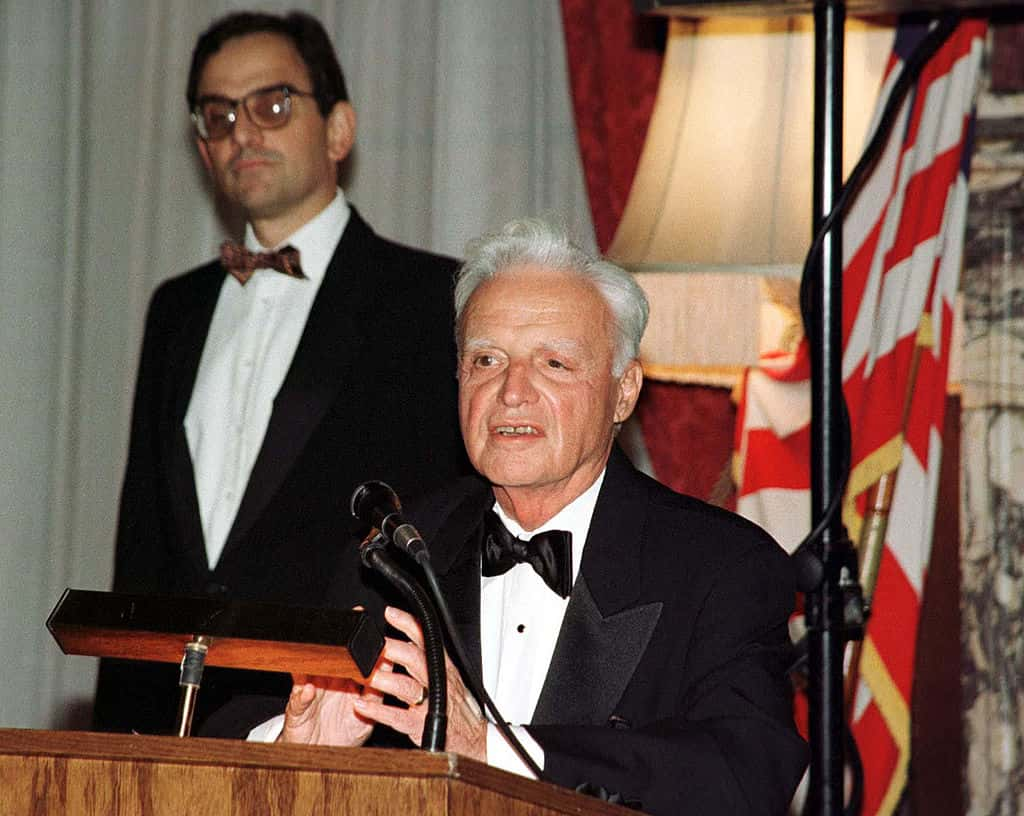

3. The White Knight Of Wall Street

Richard Whitney’s desperate, and ultimately futile, attempts to prevent the 1929 market crash won him praise from other financiers and led to him being named president of the New York Stock Exchange. Unfortunately, it was behaviour like Whitney’s that caused the crash in the first place: An obsessive trader who liked to gamble on his investments, Whitney continued to lose money, borrowing from wealthy friends and eventually embezzling from his clients. When he was apprehended in 1938, 6,000 people turned up to watch him being escorted away in handcuffs.

4. Whale Of A Scandal

In 2012, JP Morgan Chase’s London office reported a loss of $6.2 billion. In what came to be known as the “London Whale scandal,” the losses were traced back to trader Bruno Iksil, who had hedged bets on several credit default swaps, hoping to turn a profit for the company. This backfired spectacularly, and led to an investigation by the US government and an agreement by the bank to pay back $920 million to investors.

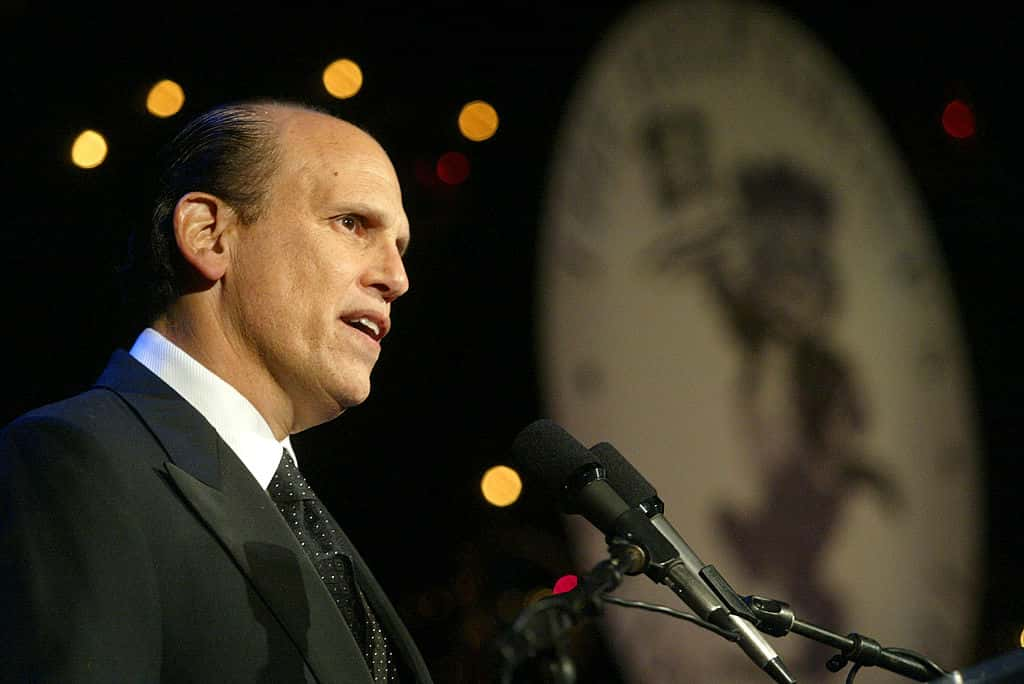

5. The Junk Bond King

Michael Milken specialized in junk bonds, high-risk investments which could nonetheless yield very high rewards. In fact, around Wall Street, everyone knew Milken as the “Junk Bond King". But how did Milken make his junk bonds pay off every time? Through a combination of indifference to SEC regulations and insider trading, of course. Milken would later be charged, and serve time, for everything from racketeering to tax evasion. Milken pulled out of it just fine, though: by 2010, he was the world’s 488th richest person.

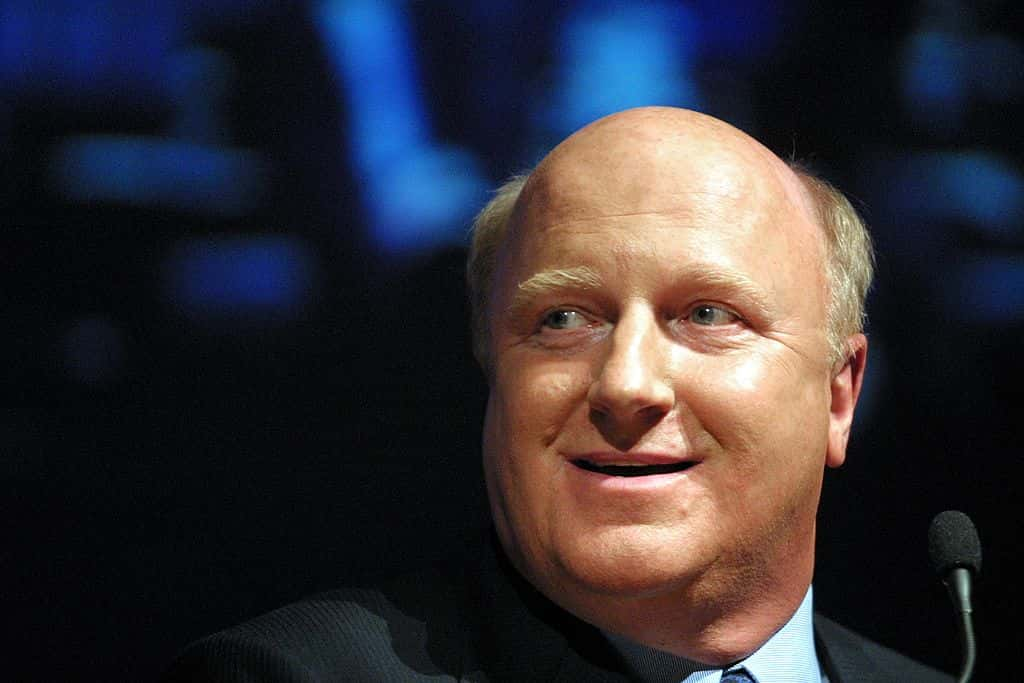

6. The Real-Life Gordon Gekko

Oliver Stone didn’t invent Gordon Gekko whole-cloth. The villain of Wall Street was based in part on stock trader Ivan Boesky, who actually delivered the now-famous “greed is good” line at a business school commencement speech. In the 1986 speech, Boesky said, "I think greed is healthy. You can be greedy and still feel good about yourself".

Wall Street,Twentieth Century Fox

Wall Street,Twentieth Century Fox

7. The Wolf Of Wall Street

Just as Wall Street shaped movie-goers’ perceptions of stock traders in the 1980s, another movie did the same thing for movie-goers a generation later. The Wolf of Wall Street was based on the life of Jordan Belfort, who scammed investors through his Stratton Oakmont firm to the tune of $200 million. Following a two-year period of incarceration, Belfort penned his memoir and currently operates as a motivational speaker.

8. Bre-X

In October of 1995, Canadian mining company Bre-X announced that it had discovered a massive gold reserve in Indonesia. Stock in the company skyrocketed to more than $200 a share. Two years later, it appeared that Michael de Guzman, a Bre-X geologist, fabricated his own disappearance. Michael allegedly took his own life by leaping from a helicopter in Busang, Indonesia. Four days later, a body was found that had been largely eaten by animals. A body had allegedly been stolen from a morgue in the city from which the helicopter had departed, and the body discovered was never confirmed to be Guzman by a reliable source. An independent firm investigated the reserve and was shocked to find that their own core samples showed "insignificant amounts of gold". The truth came out: the gold had been planted, some of it shaved off cheap jewellery. Stock plummeted, and Bre-X was forced to file for bankruptcy protection.

9. RefCo

RefCo, a New York-based financing firm, became a publicly-traded company in August of 2005. By the end of its first day on the stock exchange, it was worth $3.5 billion. Not too shabby for a day’s work. That success would be short-lived, however: it was later revealed that, prior to entering the stock exchange, RefCo had obscured $430 million in debts, not to mention another $525 million in fake bonds. RefCo was defunct by October.

10. The 2008 Recession

2008 saw the biggest financial crisis since the Great Depression. The simplest version goes like this: banks offer high loans to prospective homeowners who are unlikely to pay them; price of housing goes up; owners indeed can’t pay back loans; debt accrues and spreads to other industries and countries. There was blame enough to go around: investment bank Lehman Brothers went bankrupt, and many others were bailed out by the US government.

11. The Biggest Insider Trading Scheme In History

Raj Rajaratnam began his career as a loan officer and analyst before starting his own investment firm, the Galleon Group. Rajaratnam used his connections at other firms to obtain private stock information, taking advantage of rising or dropping stock before that information became public knowledge, thus unfairly adding $60 million to his hedge funds.

12. Dennis Kozlowski

Former Tyco CEO Dennis Kozlowski was found guilty in 2005 for misusing company funds. He paid himself a small unauthorized bonus of $81 million, purchased $14.725 million worth of art with company money, and paid a $20 million investment banking fee to Frank Walsh, a former Tyco director.

13. Adelphia

John Rigas built his telecommunications company, Adelphia, into one of the biggest cable providers in the United States. Behind the scenes, however, Rigas and his family were quietly covering the company’s $2.3 billion debt, plus skimming nearly $100 million for themselves.

Once they were caught, Adelphia was forced into bankruptcy and bought out by their rival, Comcast. Things only deteriorated for Rigas: he received a sentence of 15 years of incarceration, and the subsequent fines rendered him practically penniless. He even had to sell his hockey team. Boo-hoo.

14. Samuel D. Waksal

Samuel D. Waksal started his career as medical researcher before being chased out of that field for faking lab results. So where should an ambitious, intelligent man with absolutely no scruples turn? Wall Street, naturally. Waksal founded a biotech company called ImClone, which developed an anti-cancer drug called Erbitux. Interest was so great that Waksal started selling his own shares in the company. Unfortunately, he failed to mention a tiny detail: the drug didn’t work and the FDA was about to reject it, making the stock all but useless. On June 12, 2002, Waksal was taken into custody for insider trading.

15. Joseph Nacchio

Joseph Nacchio was CEO of Qwest Communications, one of dozens of telecom companies jostling for supremacy during the tech boom of the late 1990s. Under Nacchio, Qwest maid rapid gains, winning contracts and buying out competition. The catch? The contracts were often made up, driving up stock and giving Qwest the capital to buy out weaker competition. Nacchio personally made $52 million selling fraudulent stock, an action which obligated him to return the money before commencing a period of incarceration.

16. Sam Israel

Sam Israel, head of the Bayou Hedge Fund Group, had a habit of embellishing the truth. Sam Israel had already promised his investors millions of dollars in returns, but when a slow fiscal year ensured the already-unlikely pay off impossible, he began forging accounting reports. He swindled $450 million from his investors and ended up on America's Most Wanted following a staged simulacrum of his own demise.

17. ZZZZ Worst

Barry Minkow created his carpet cleaning company, ZZZZ Best, in high school (it’s pronounced Zee Best—he named it in high school, too). In order to grow his company, he started faking documents. He did this so much that he was able to take his small, independent carpet cleaning company public. It was later revealed that, by the time the scheme collapsed, up to 90% of ZZZZ Best’s business was made-up.

18. WorldCom

WorldCom was one of the world’s largest communications companies. Helmed by Bernie Ebbers, WorldCom engaged in a massive conspiracy to inflate profits by $11 billion. When the scheme was uncovered, WorldCom collapsed under the strain of reimbursing $6 billion to investors, and Ebbers was sentenced to 25 years of imprisonment.

19. The Enron Bankruptcy

With revenues of $100 billion, and a slew of “Most Innovative Company” titles from Fortune, Enron seemed like major success. Unfortunately, Enron was a little too innovate: through a series of frauds and iffy accounting, it seems billions of dollars of Enron’s money didn’t really exist. The scandal not only devastated Enron and their auditing firm, Arthur Andersen LLP, but also resulted in Enron's CEO Jeffrey Skilling being imprisoned for 14 years. Enron's founder and former chairman, Kenneth L. Lay was also convicted but met his end before sentencing while vacationing in Aspen.

20. The Informant

Enron’s CFO, Andrew Fastow, escaped the scandal relatively unscathed. Despite facing 78 charges related to deception, money laundering, and conspiracy, Fastow testified against other Enron officials, thereby reducing his sentence to a manageable six years.

21. Libor-ated

The Libor Rate is a global standard of interest applied to $350 trillion in assets around the world. In 2008, however, on the heels of the financial crisis, the Wall Street Journal alleged that some banks were understating their Libor-applied assets so as to profit from lower interest rates. These claims were later confirmed by an independent study.

22. Not A Good Thing

It seems all this financial wheeling and dealing can make anyone a little sneaky. Even sunny arts and crafts queen Martha Stewart made headlines in 2001 when she sold off her shares in a little pharmaceutical company called ImClone just hours before the stock fell 16%. Her stockbroker had tipped her off before news of the collapse had gone public. Stewart spent five months in captivity and covered $30,000 in penalties for her insider trading activities.

Getty ImagesSources: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16

Getty ImagesSources: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16